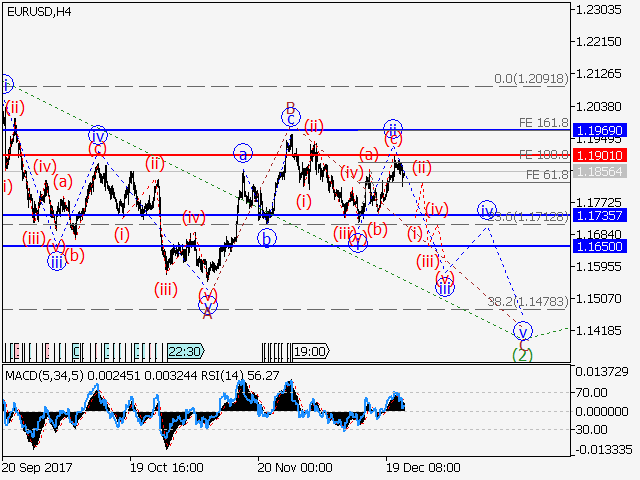

Estimated pivot point is at a level of 1.1901.

Main scenario: short positions will be relevant from corrections below the level of 1.1901 with a target of 1.1735 – 1.1650.

Alternative scenario: Breakout and consolidation above the level of 1.1901 will allow the pair to continue rising to a level of 1.1970 and higher.

Analysis: Supposedly, a descending correction in the form of the wave (2) continues developing in the 4-hour time frame, with an ascending correction in the form of the wave B completed and the wave C developing inside. Apparently, the first wave of junior level i of C has been formed and the ascending correction in the form of the wave ii of C has finished locally. If the assumption is correct, the pair may be expected to continue falling to the level of 1.1735 – 1.1650. The level 1.1901 is critical in this scenario.