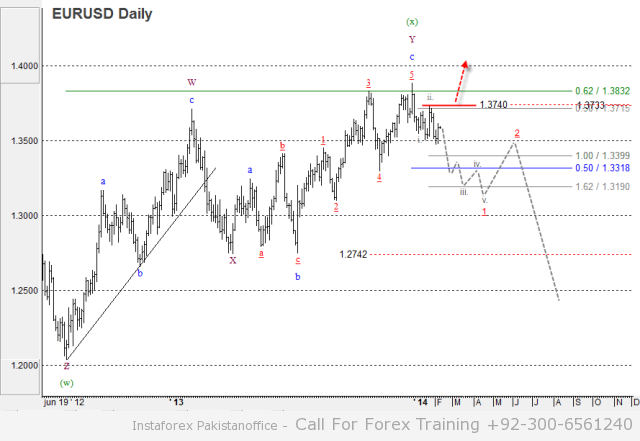

EUR/USD: Wave analysis and forecast of 07.03 – 14.03: Growth in the pair is likely to continue. Estimated pivot point is at the level of 1.3706.

For Detail Analysis, Trading Signals and Complete Forex Training In Urdu Call Us +92-300-6561240, Or Visit http://www.pakeagle.com.pk

Our opinion: Buy the pair from correction above the level of 1.3706 with the target of 1.3940.

Alternative scenario: Breakout of the level of1.3706 will enable the price to continue decline to the levels of 1.36 – 1.35.

Analysis: Due to breakdown of the critical level and ongoing rise in the pair, wave analysis can be interpreted in favour of the rise in the pair. Updated chart shows that, the formation of the final wave as part of the ascending correction of the higher level, which can take a shape of a diagonal, is possible. Locally the fifth wave is being formed, which can take a shape of the final diagonal triangle, which can be completed at the level of 1.3940.