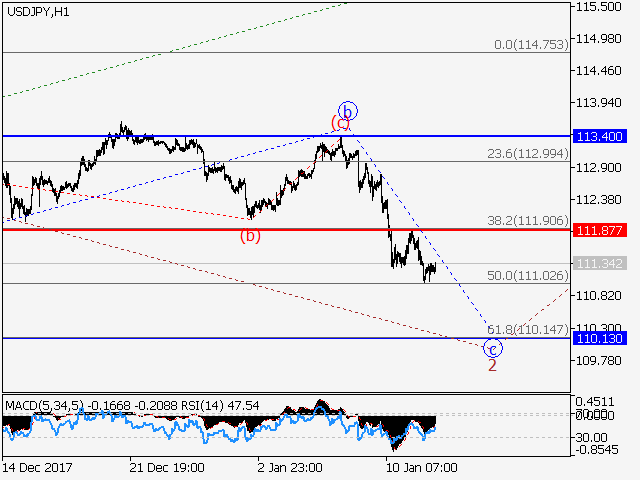

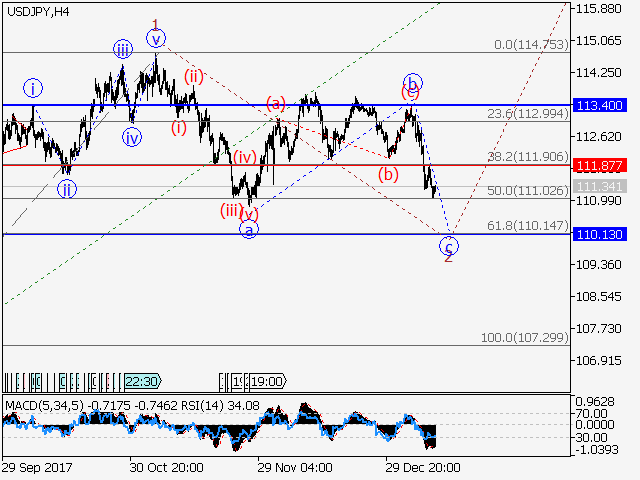

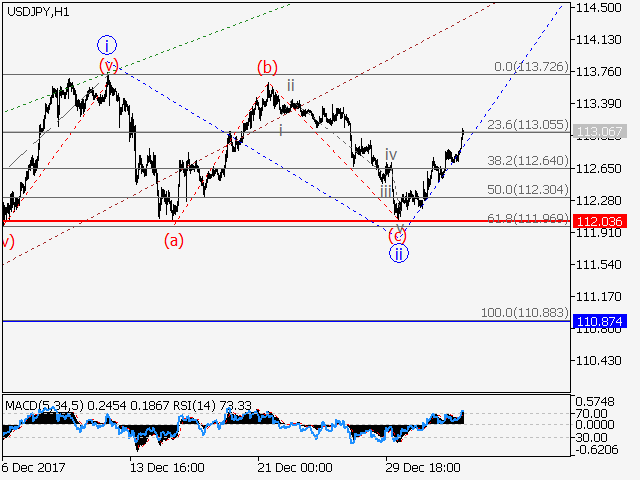

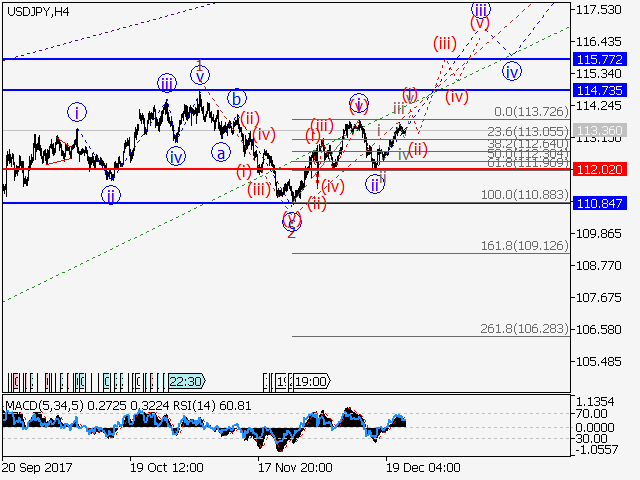

USD/JPY Wave analysis and forecast for 12.01 – 19.01

Estimated pivot point is at a level of 111.87.

Main scenario: short positions will be relevant from corrections below the level of 111.87 with a target of 110.13.

Alternative scenario:breakout and consolidation above the level of 111.87 will allow the pair to continue rising to a level of 113.40.

Analysis: Supposedly, a descending correction in the form of the wave 2 of senior level continues developing within the 4-hour time frame. Apparently, the wave c of 2 is now developing locally. If this assumption is correct, the pair will continue to drop to 110.13. The level 111.87 may be critical in this scenario.